Bukie Adebo Umeano - Anthemis Group

"Great founders have to be able to convince people to do irrational things."

Connect with Bukie

You can find me at bukie@anthemis.com

VC Uncovered's View

Bukie’s journey from failed founder to thesis-driven VC embodies the very ethos we champion at VC Uncovered: investors who bring fresh perspectives and bold approaches to backing tomorrow's breakthroughs.

Bukie's perspective is particularly compelling because she blends her Nigerian immigrant family's emphasis on knowledge with her natural inclination toward "strong opinions, loosely held." This combination produces an investor who develops deep theses about industry directions while remaining open to challenging her own views.

Bukie's call for more contrarian thinking and bigger bets resonates deeply with our mission. Her insights on invisible finance and AI transforming previously overlooked sectors highlight why we need investors willing to venture beyond established narratives and conventional wisdom.

Bukie exemplifies the next generation of VCs reshaping the future—those who understand that breakthrough innovations rarely emerge from consensus thinking.Meet Bukie

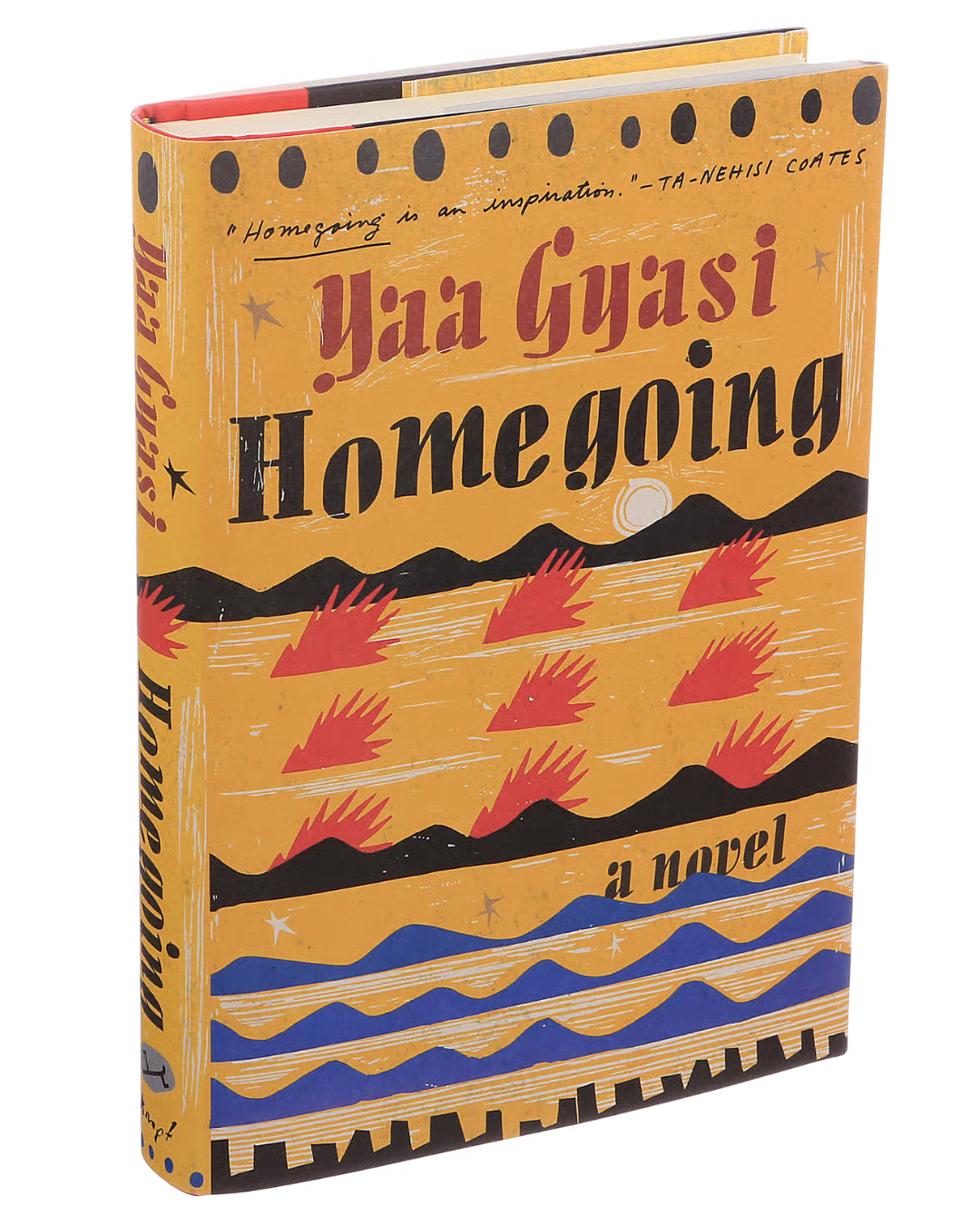

Q: You can be anywhere. Eating, drinking, and reading your favorite thing. What is it?

A: I’m at a cafe in Tangier, Morocco. Drinking a flat white, eating a slice of cake, and reading Homegoing by Yaa Gyasi.

Key Quotes

"Great founders have to be able to convince people to do irrational things."

"I decided to pursue a career in venture after attempting to build a venture-scale business myself."

"Nothing has shaped my worldview more than my family. My parents immigrated to the US from Nigeria to pursue higher education."

"The best founders are driven by a true passion for the problem they are solving."

"I would love to see the industry move towards more contrarian thinking and bigger bets."

Original Responses (Lightly Edited for Clarity and Flow)

Background and Personal Journey

Moment Inspiring Venture Capital Career

After attempting to build a venture-scale business myself, I decided to pursue a career in venture. I co-founded a fintech company with two business school classmates, and while the business was ultimately unsuccessful, immersing myself in the world of early-stage tech was a game-changer. As a former consultant, I was used to months-long projects that barely moved the needle at massive organizations. With my startup, we were constantly testing, learning, and making impactful decisions. However, I did miss the breadth and context switching of professional services. Venture capital was the perfect way to marry both interests and lean into my strengths. This role allows me to engage with early-stage founders, navigating some of the quick decisions and changes in startups. It also allows me to develop industry theses and POVs that stretch over longer timelines and build portfolios with 10-year time horizons.

Influences on My Worldview

Nothing has shaped my worldview more than my family. My parents immigrated to the US from Nigeria to pursue higher education. Both of them instilled the value of learning at an early age. They encouraged us to explore and learn beyond the classroom, teaching us that “knowledge is power”. While you can't know everything in venture (if anything, this is an industry of unknowns), I believe in a thesis-driven approach. I take time to form high-level perspectives on where certain industries and verticals are moving and use that to guide my investment decisions.

I am also one of four sisters who are truly my best friends. Anyone who has spent time with us as a unit can attest that we're an energetic, opinionated, and sometimes exhausting group. A lifetime of hot takes and unnecessarily passionate debates gives me the confidence to make quick decisions and the self-awareness to challenge my views. I am a big proponent of "strong opinions, loosely held," and I try to navigate investment decisions with this mentality.

Best Advice Received

An old colleague told me that not all feedback is created equal. A third of the feedback you receive is spot-on and should be incorporated into day-to-day work immediately. A third is context-specific, so it should be applied to certain people or on certain projects, but shouldn't be seen as universal. Finally, a third is pretty useless and should be disregarded. Your job is to figure out the appropriate category.

I've expanded that guidance to apply to all the information we absorb regularly. We are bombarded with content and ideas every day. One of the most important skills to cultivate as an investor is discernment, which means thinking critically about every source's credibility, motivation, and context. As we consume information, it's important to question every element and consider where we assign value.

Philosophy and Insights

Values When Working with Founders

When working with founders, I am honest about my limitations but generous with my insights. I appreciate that founders will always know their business and space better than I do, but I bring learnings from other deals and portfolio companies. Finally, I try to be in your corner. I'm a "cheerleader" by nature, and I love playing the role of supporter and encourager, but I also give frank and honest feedback when necessary.

When looking for founders, I focus on the following:

Great founders have to be able to convince people to do irrational things. Whether convincing top talent to trade job security and pay to help you make your vision a reality or convincing customers or investors to bet on your early-stage company, it requires a unique level of confidence, magnetism, and thoughtfulness.

The best founders are driven by a true passion for the problem they are solving. They're obsessed with the space, the customer, or the transformation. While money is a great motivator, I believe that generational businesses are underpinned by intrinsic motivation.

Strong founder-investor relationships are built on transparency and self-awareness. I look for founders who are honest about their strengths and weaknesses and who see their investors as thought partners.

Finally, I like an eclectic background. While it isn't an absolute necessity, I love it when people are willing to make big career changes, explore different paths in life, and dive into unique hobbies. A lot of the time, the creativity and excellence that people exhibit throughout their lives become evident in their founder journeys.

The Perfect Founder Pitch

It begins with a bold vision and outlines the current pain point or overlooked opportunity. Spending a lot of time describing the problem or need is essential. Bring it to life so that I'm desperate for it by the time we get to the solution! Then, it articulates a unique and well-reasoned product and business model, including why that approach is differentiated and ideal for the customer base. It also discusses current traction and progress towards that future vision. This should include everything from concrete metrics to qualitative feedback and learning. Finally, and this can come earlier, it includes details about the founding team and why they are uniquely positioned to build this business.

I tend to walk away with a new insight or POV when a pitch is extremely compelling. If a founder can help me think differently about a space I've encountered a dozen times, I'm excited to learn more. However, novelty and vision also need solid execution. That's why I love to see founders ground their boldness in a thorough plan and a clear-eyed assessment of their capabilities.

Measuring Success Beyond Returns

On a smaller scale, I measure impact in relationships. It's so easy to leave a lasting impression (positive or negative) with each interaction. I value genuine connections with founders, investors, LPs, etc., and I strive to operate with integrity and thoughtfulness. When people seek me out as a trusted partner, or I can easily find people when I need support, those are signals of this type of success.

Financial services have an outsized impact on people's everyday lives on a larger scale, and as an early-stage investor, I have a role (however small) in shaping the industry. As a firm, we seek out solutions that not only ‘do no harm’ but actively drive a more transparent and inclusive financial system.

We also work to push the industry forward through thought leadership and collaboration. This values alignment is a big part of what led me to Anthemis in the first place.

Trends and Future Vision

Exciting Trends and Technologies

We are moving into the next wave of financial services innovation. Given advancements in data infrastructure and generative AI, financial services distribution is shifting from embedded to invisible. In the world of invisible finance, financial products will feel more like utilities powering our lives and businesses than products with discrete and cumbersome workflows.

For finance to be invisible, it must deeply understand users and context and operate autonomously and efficiently. The first two components are driven by open finance, data sharing, and better technology for gathering real-world data. The final component is accelerating rapidly due to AI. Some aspects of invisible finance will take a while to materialize, but I am already starting to see the signs of this shift in areas like wealth management, payments, and banking.

In addition to the broader industry themes, I am excited to see AI transform spaces where investors have shied away in recent years, like consumer fintech and services. As AI agents upend traditional go-to-market strategies and 100x professional services productivity, the margins for both spaces become significantly more appealing.

Misconception About VCs

It is a misconception that a VC's role is to offer depth of expertise in any particular area. I see the value in a thesis-driven approach, which usually involves a high-level point of view. VCs are generalists. No matter how hard we try, we can't predict the future, and most investors intentionally keep an open mind, seeking out innovative businesses that fit into a broader POV of where the world is heading. If we get too narrow, we might miss out on big opportunities or major shifts in the market. Another reason investors need to play a generalist role is that it allows us to draw patterns and learnings across our portfolio to support individual teams. The breadth of experiences (vs. the depth) is typically how most VCs can offer tangible value to businesses.

Improving the VC Ecosystem

I would love to see the industry move towards more contrarian thinking and bigger bets. This job has incredibly long feedback cycles, and knowing if you're making the right call is hard. Because of that, many investors gravitate towards more obvious signs of validation and repeatedly chase the same types of ideas and the same types of founders. I am guilty of this, too. Sometimes, there's wisdom in learning from the past, but oftentimes, these blinders limit innovation and returns. I would love to see more nonconsensus bets, particularly at the Pre-Seed and Seed stages. This will accelerate the pace and breadth of impact in the venture and startup ecosystem.