Jason Freedman - Orange Collective

“If it looks like a toy, it might be a huge company”

Connect with Jason

www.linkedin.com/in/jasonfreedman

VC Uncovered’s View

Jason Freedman and Orange Collective are executing a playbook that brings VC back to its roots: a deep, altruistic belief in people.

As multi-stage funds crowded out what Jason calls “The Art of the Angel Investment,” Orange Collective emerged from a network of over 150 Y Combinator alumni. Their goal is to restore the original, nimble YC ethos of “paying it back” by backing the next generation of top AI founders emerging from the accelerator.

What truly sets Jason’s approach apart, and why we’re featuring him here on VC Uncovered, is his radical commitment to respecting founders’ time. Orange Collective flips the traditional investment process on its head. They conduct their internal investment research before ever taking a first meeting. They don’t take a meeting unless they are already highly confident they want to invest.

This simple change is a profound challenge to old-school venture capital. Many VCs demand founders “build a partnership” (i.e., spend time with them). In contrast, Jason borrows his philosophy from Paul Graham: the best founders should be talking to customers, not investors. This focus on efficiency, combined with a thesis of backing unpopular ideas that look like toys and judging companies on their “slope, not y-intercept,” makes Orange Collective a prime example of the agile Uncovered philosophy.Meet Jason

Q: What is your ideal place? Where’s your happiness point?

A: I get my happy place every single day. My kids vibe code and the current app they’re working on is a dice roller for the game of Risk. After my wife goes to sleep at like 8 p.m., we play Risk for hours and hours. There’s no bedtime with Dad if the game is close. At the end of the game, it’s all this dice rolling and so they vibe coded a little app that does the dice rolling at the end of the game. It’s sharing my thing that I do, but they’re on Replit; kids eight, nine, and 11, they’re gonna live different lives. Nothing better than playing board games with your own.

Key Quotes

“If it looks like a toy, it might be a huge company”

“We spend a lot of time on the unpopular founders and the unpopular products. What we’re looking for is a small slice of user or customer love.”

“The VCs who are the best really empathize with the founder and say, I would rather this founder work with customers than get to know me.”

“We don’t take meetings with founders unless we are very confident we’re gonna want to invest.”

“One of things I’m most proud of is that my kids see me work hard.”

Original Responses (Lightly Edited for Clarity and Flow)

Background and Personal Journey

Experiences Shaping My Investment Approach

I’ve spent most of my investing career as an Angel Investor, and angel investing in the Y Combinator ecosystem where Orange Collective lives. Paul Graham knew that angel investors punch above their weight class when it comes to treating founders a certain way. The history of angel investors in Silicon Valley and the Startup Ecosystem is you believe in people and you help them in a really altruistic way. You’re paying back people who helped you.

Moment Inspiring Venture Capital Career

Back in the day, when I was in YC (I did a ‘09 and winter ‘12 for my two companies), we had alumni demo day. The alumni would show up, and you would listen to what people wanted to build. Then you’d hand them a check and a handshake. For years after I did my demo days, raised my capital and started my companies, I would go to every demo day and bring my checkbook. I didn’t have much money. I would just meet people who were building interesting things that I wanted to exist in the world, and I would hand them checks.

Fast forward, Y Combinator is now super popular. A gazillion investors in the world compete for allocation of these startups. What my fellow GPs, Ryan and Dave, and I realized is: The art of angel investment had been crowded out. Angel investing was now like a competitive event and you’re up against multi-stage funds.

Orange Collective is a whole bunch of angel investors who are all LPs. They write hundreds of checks into every YC batch, and we share openly with each other all of our notes.

Unconventional Belief

We do our IC before meeting the founder for the first time. The final step will be meeting the founder. This means we do a tremendous amount of work in companies we never end up investing in. It’s the same work, but we flipped the timeline. We don’t take meetings with founders unless we are very confident we’re gonna want to invest.

The biggest Y Combinator companies ever have always been in spaces where no one was really looking at the time. They start as companies that don’t materially look like the company that they end up in. We have a saying for this: “If it looks like a toy, it might be a huge company”. We follow that with a really high degree of respect. A different version of this comes from Peter Thiel, which says: “The biggest companies are companies that will work and were unfairly unpopular at the time”. We spend a lot of time on the unpopular founders and the unpopular products. What we’re looking for is a small slice of user or customer love. We are especially interested if it’s an underdog.

We were the first big investor in Autumn Pricing, which allows companies who sell access to tokens through some sort of vertical SaaS or developer tool that makes it easy to bill for them. The one company over the last 10 years you don’t want to compete against is Stripe. Definitely not as a YC company. Who’s going to touch a thing that’s adjacent to Stripe?

They were founders who skipped their demo day because they didn’t have anything to show yet. Then they skipped the next demo day because they still didn’t have anything to show yet. When we met them, it was two guys sitting in their apartment. They had raised rounds to zero money. Everyone had written them off. They said, “I just don’t think anyone understands the quantity of work it takes to bill when people are using AI agents and using tokens. You need to track the tokens and give low-latency feedback to the developer on how many tokens have been used from which model at which pricing tier.”

This is not a billing question. This is an entire category of software. Everyone’s rolling their own, and it’s horrible and painful.

Then we found developers using the product who said: ”We’re getting our bugs fixed at 2 a.m. on a Saturday.” The developers are just in love with these two founders and how good they are at helping them. This is why love the underdogs who have a reason not to succeed. That’s a big portion of our investment process: Why is this an underdog?

Balancing Intuition with Data

First of all, we believe in slope, not y-intercept (famous YC saying) so we don’t care what level of revenue you’re at. We care about the angle of ascent. For Open Source companies, we just track the star history and NPM downloads and calculate the slope. It’s the easiest data in the world.

The best data point in the entire world is using a product in your own company where it is material to you that it works and liking it and becoming a 10 out of 10 NPS on that product and founder and then investing your own money in that founder. In our portfolio, we often get that to occur five to 10 times.

Best Advice Received

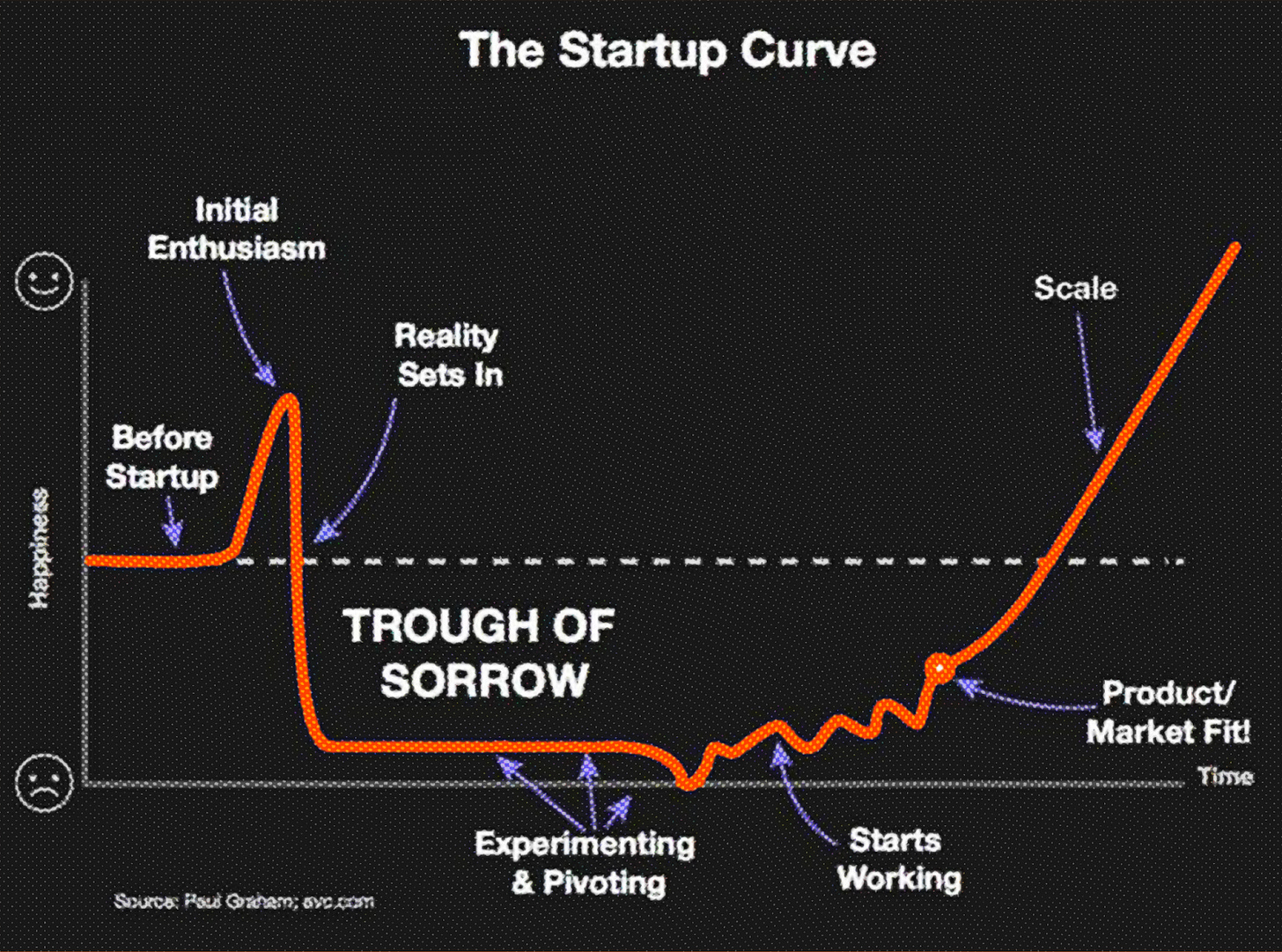

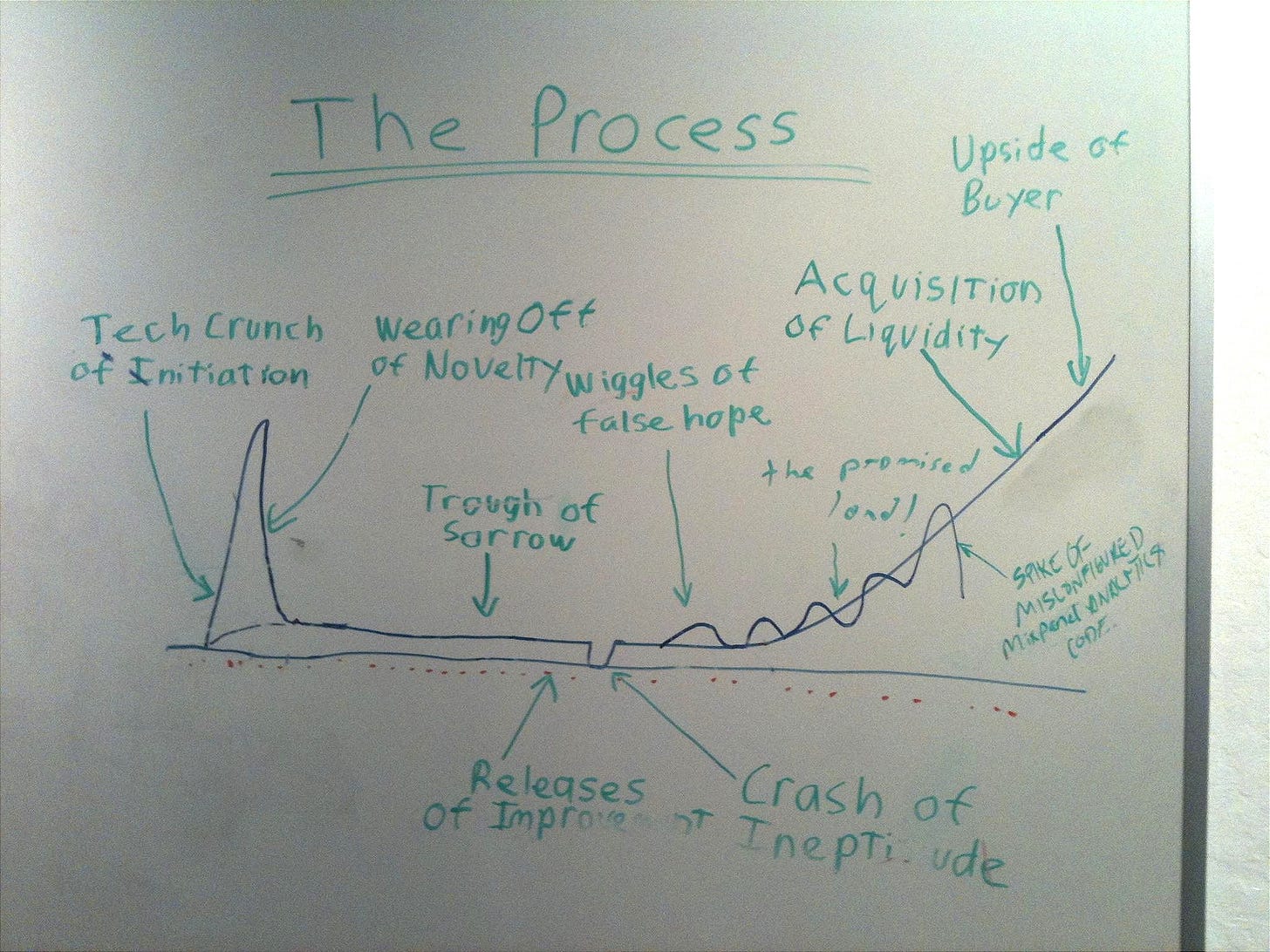

When I say that YC kids have good heads on their shoulders, it’s mostly because they’re not afraid of the trough of sorrow (see below). They don’t need to be on a rocket ship. They wanna be founders that never give up, because that’s what YC teaches you. They say: “Our heroes are the people who never give up.”

Philosophy and Insights

Investment Philosophy

Back in the early days, a bunch of us founders were dealing with the fact that our companies weren’t going very well.

Paul Graham drew a graph and said, this is what it’s like: There’s your tech crunch of initiation, the “Initial Enthusiasm” you encounter. Then, there’s the wearing off of novelty. Then there’s this long “Trough of Sorrow”. After that, you have this release of improvements followed by the crash of ineptitude. It’s not until after that you finally get to work.

What I tell founders is “the faster we get to your crash of ineptitude, that’s where all humility is returned.”

That’s when we’re your best investor. Your other VCs might’ve written you off: they’re no longer on your board and they’re no longer bragging about you, but this is where we go to work. Just improve yourself 5% week over week. Then you can get to the wiggles of false hope.

Values When Working with Founders

We care tremendously about the number of meetings where we say “no” and our entire process is optimized around decreasing those meetings. Because every time you meet with a company and then say no, you’ve wasted that founder’s time. We track personally our “dollars per meeting scheduled” metric. We are number one for dollars per meeting scheduled, and that’s why we get first meetings. Nothing beats being efficient with a founder’s time in terms of value add. It’s the number one thing first.

The VCs who are the best really empathize with the founder and say: “I would rather this founder work with customers than get to know me, and I’m okay knowing that the founders made a choice between me and a customer.’’

The Perfect Founder Pitch

Here’s the best pitch deck you can do: Here’s my growth. Here’s what my customers think about us. Here’s how we could become big someday. Here’s why I love working on this, and here is who I work with.

That’s the best pitch you can do at Seed and with the smallest amount of words.

If you just do the “here’s our growth,” the VC can do the rest with their own research.

Approach to Risk

I believe there are only two types of investors. There are those who value their deal flow and those who use someone else’s deal flow. I think 99% of investors incorrectly value their own deal flow. I will not allow us to use that deal flow to make our investments because it does not compare to the deal flow of Y Combinator.

So why are we a YC portfolio only? Because we constrained ourselves on purpose. I look at my past track record of angel investing, 150 companies and if you circle just the YC investments, it’s phenomenal. If you include all my other decisions for various reasons, everything falls. That’s how good YC is.

Measuring Success Beyond Returns

One way is to ask, did your top companies give you super pro rata? It’s a way to evaluate how your portfolio thinks you did in serving them.

Trends and Future Vision

Exciting Trends and Technologies

I am on a mission to make Europe startup-friendly.

35% of our portfolio are European founders who moved to the US for Y Combinator. Europe has great universities. The global pool for building great companies is global because it’s based on great founders. Europe is exposed to lots of problems that great founders can fix. Europe right now is saying: “This is really important to us. We need to fix this”. I’m very optimistic about Europe. They’ve got great founders who are currently leaving them and wish they weren’t.

Misconception About VCs

I have been to every Demo Day since 2009. I’ve seen VCs complain about prices. You are a founder and your group partner is telling you nothing is more important than writing code and talking to your users. That excludes something, which is building a partnership with your investors. Investors feel hurt that the founders aren’t willing to build a partnership with them. I think there’s actually a lot of the complaints of YC because the investor feels hurt. The VCs who are the best really empathize with the founder and say, I would rather this founder work with customers than get to know me. If you phrase it that way versus like “the founders like speed dating me” it just helps you empathize with where they’re spending their time.

Improving the VC Ecosystem

Adverse selection created by ownership targets.

I think it’s the biggest value destructive thing LPs do with their GPs. All of a sudden they’re passing on companies because they can’t get the ownership percentage that they promised their LPs.

What they’re not including is the value they never saw added to their portfolio because they got small ownership in great companies passing because you didn’t get enough for it to be worth it, that is a small-minded decision. I think (European) LPs need to relieve GPs of the burden if they want better returns.

Again, I am on a mission to make Europe startup friendly. We are going to create a list of investors in Europe who can commit to appropriately timed decisions. The European investor will not be able to get the deal done in time. I have talked to all of the top tier YC European founders and they’ve all said this is exactly the same thing.

We talked to all of their LPs and the European LPs did not understand that their request for 35 page memos for a 200K investment is what’s causing adverse selection for their VC funds.

Early Challenges for Founders

Y Combinator has been in an experiment for 20 years to say, What is the least amount of time founders can waste on fundraising versus writing code and talking to users? YC’s worked really hard to convert fundraising into customer time.

Ask yourself, what can I do to be earlier? And the number one thing you can do to be earlier is make it easier on the life of founders to receive your money, because those are the meetings they take first.