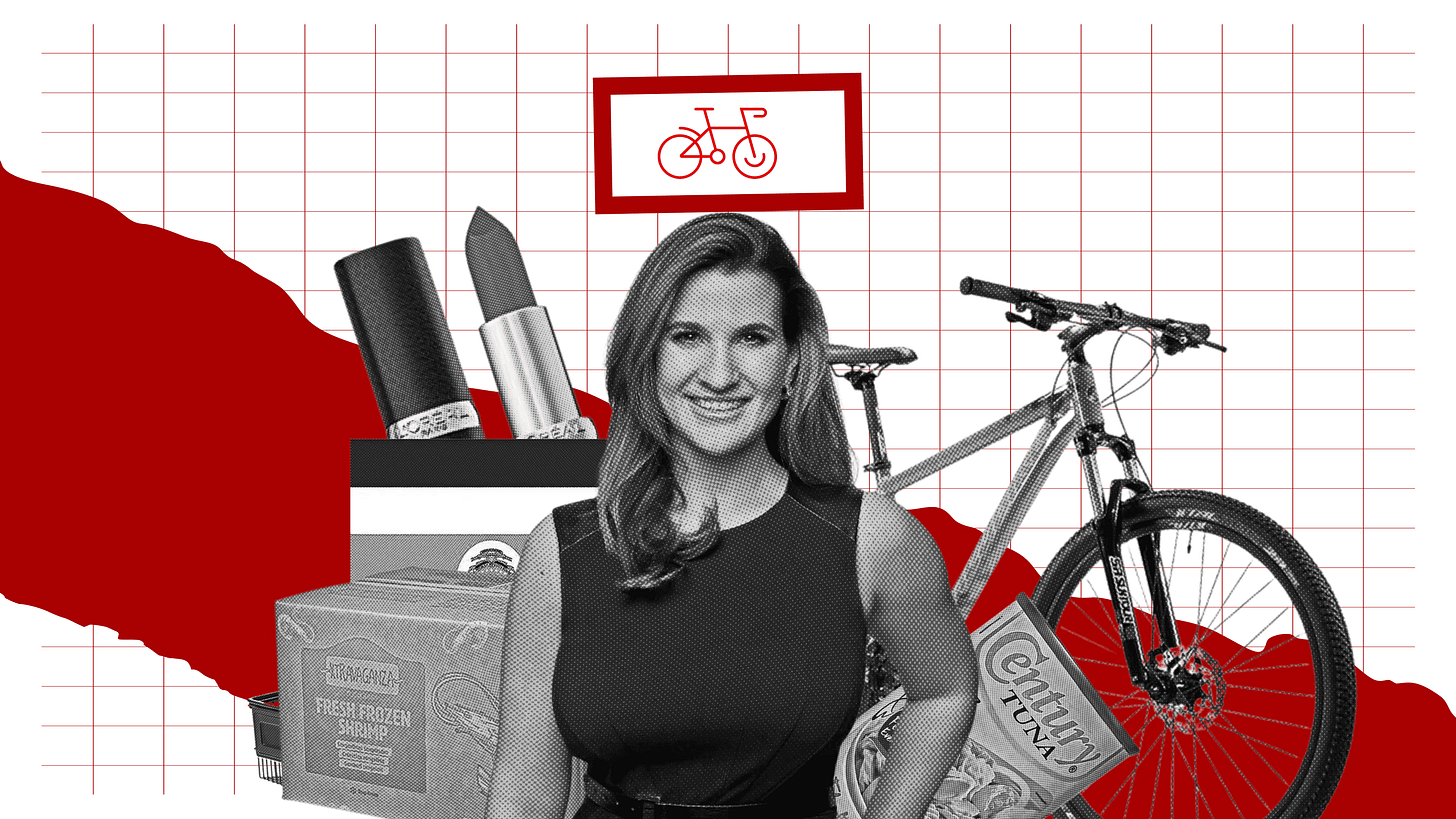

Rachel ten Brink - Red Bike Capital

"As we're moving faster and faster with AI, you're able to build businesses faster with AI. You actually go back to deeply human skills in order to differentiate."

Connect with Rachel

https://www.linkedin.com/in/rachel-ten-brink

VC Uncovered's View

Rachel ten Brink’s journey into venture capital didn't start in an MBA program or an investment bank. It began by people-watching in the canned tuna aisle of a supermarket in Costa Rica. As a child, she observed shoppers, analyzing the subtle cues that drove their purchasing decisions. She was learning lessons from her entrepreneur father about risk, opportunity, and the fundamentals of how businesses actually make money.

This grounding in real-world commerce, later refined by fifteen years at corporate giants like L'Oreal and the high-velocity experience of co-founding the YC-backed Scentbird, shapes her distinct approach at Red Bike Capital. Rachel represents the new breed of investors we champion at VC Uncovered, those who blend vision with practicality, or as she puts it, "head in the clouds but feet on the ground."

While legacy funds often get distracted by hype cycles or overly elaborate pitch decks, Rachel and the team at Red Bike focus on what truly drives results for early-stage companies: distribution and capital efficiency. They don't just write checks; they connect. They roll up their sleeves and help founders land their first enterprise clients. This commitment to the "say-do ratio," ensuring promises of support translate into tangible action, is crucial in a VC landscape where founders often receive capital but little ongoing help.

Perhaps most insightful is Rachel’s perspective on the future. In a world accelerating with AI, she believes the true differentiator won't be the technology itself, but the "deeply human skills" required to sell it, build relationships, and navigate complex organizational dynamics. By backing experienced technical founders out to solve big problems in Data, AI, and Fintech, Rachel is proving that operator-investors, who have walked in the founder's shoes, are best positioned to identify and guide the next wave of innovation.Meet Rachel

Q: You can be anywhere. Eating, drinking, and reading your favorite thing. What is it?

A: On the beach in Costa Rica—home for me—with my family. My feet are buried in the sand, a frozen margarita with salt in hand, watching the sun sink into the ocean as I read one of my favorite Latin American magical realist authors, Isabel Allende or Gabriel Garcia Marquez.

Key Quotes

"Head in the clouds; feet on the ground."

"As we're moving faster and faster with AI, you're able to build businesses faster with AI. You actually go back to deeply human skills in order to differentiate."

"80% of our deal flow is founders recommending founders. That is the highest quality of deal flow."

"I call it the say-do ratio. Right? Like, if I say I'm gonna do something, do I actually do it?"

"I wish there were an easier way for LPs to understand and to see the value of why you want to invest in emerging managers, why these, like, outlier voices can lead to outlier returns."

Original Responses (Lightly Edited for Clarity and Flow)

Background and Personal Journey

Experiences Shaping My Investment Approach

It's a combination of experiences, but I would pick out two in particular.

The first is my dad. He was an entrepreneur, the child of Holocaust survivors who ended up in Cuba, then New Orleans, and finally Costa Rica, where I was born. His life was filled with unexpected shifts and major events that were beyond his control, yet he was an incredible optimist and always an entrepreneur. He had a huge appetite for risk, a practicality, and a great sense for how businesses made money.

My dad had a shrimp processing plant, then a canned tuna brand.When I was a kid, on Sundays, we would hang out in the supermarket by the canned tuna aisle. I would watch people and observe how they decided what brand to buy. That was incredibly educational and something I still carry with me. Growing up in that entrepreneurial environment taught me to look for opportunities and understand that you can only control what you can control.

The other experience was Scentbird. It was just an incredible ride. I had come out of fifteen years in a very corporate environment, working for Procter and Gamble, L'Oreal, and Estée Lauder. I understood large companies very well, yet I always knew I wanted to be an entrepreneur.

When I met my cofounders at Scentbird, there was just a lot that you can only experience if you've walked in the founder's shoes, like modulating your highs and lows. All those experiences really helped me now that I'm on the investing side. I was part of several cohorts of founders, both in New York (ERA) and in SF (YC). You get to see a lot of founders who all start at the same time, and you begin to see what good, better, and best look like.

Unconventional Belief

I don't know if it's unconventional, but 80% of our deal flow is founders recommending founders. I am a huge believer that is the highest quality of deal flow and an incredible source of underwriting.

There is pattern recognition that comes from great founders seeing other great founders. It is much stronger than great investors assessing founders. I actually think that peer-to-peer connection is incredibly valuable and a very strong signal.

Best Advice Received

One piece of wisdom that has stuck with me was very practical, geared towards fundraising and LPs. “If you're going to try to raise money, the first people you talk to are people who you've actually made money for.” That made sense, and it has always stuck with me. You made money for people once; they'll trust you again. That was really good advice.

Philosophy and Insights

Investment Philosophy

We look for founders that have a deep connection to what they're building, a unique perspective, and are biased towards action and capital efficiency.

This idea of head in the clouds but feet on the ground is really important to me. A founder needs to be able to articulate the large vision. Not every company is venture backable. You need to achieve a certain amount of scale and a vision for where the future is going. But I am very much of the belief that if you don't have your feet on the ground, if you don't figure out early if you're going to make money and that this is a viable business, then all the head in the clouds doesn't go anywhere.

The Perfect Founder Pitch

I don't think you need to be crazy creative. It's more about clarity, focus, and knowing your business. What am I looking for in a deck? It's the typical ten to twelve slides: what's the problem you're solving, how big is the opportunity, how are you doing it, how are you making money, and who's the team behind it.

None of these are super surprising, but it's really about uncovering what you know that other people don't, how clearly you can articulate it, and how clearly you can get me on that vision to make this huge. Over-orchestrated, over-animated decks turn me off because you're losing sight of what's really fundamental.

I enjoy seeing product demonstrations and getting hands-on experience with the product. I love to listen to customer calls. I want to hear from your customer, and I'm going to send a million emails back and forth with questions. I like founders who are really thoughtful and will say, "Yeah, this is where it's a problem, but this is how I'm thinking of solving it," or, "This is where we see the arbitrage where we can really make money."

Approach to Risk and Moats

It's really interesting because I think that as we're moving faster and faster with AI, as you're able to build businesses faster with AI, you actually go back to deeply human skills in order to differentiate.

We, as a fund, focus on helping our founders land those first clients. How are you landing those enterprise clients? How are you building those relationships? How are you overcoming objections? For example, you might be selling an AI product to somebody at a bank who realizes that if they buy this product, they're going to have to fire half their department. How are you going to overcome those types of challenges? That's a deeply human conversation of really understanding their business.

When I'm underwriting these AI companies, I look at: Are they really solving a problem? Is there a moat? Is there something proprietary?

Data is still a moat. If you can combine publicly accessible data with proprietary data to draw conclusions that only you can see, that is really interesting. Distribution and relationships are still interesting; those can be competitive moats. The third moat is frictionless commerce or transactions. Can you create a product that has no friction? That's hard.

Measuring Success Beyond Returns

First of all, it's a damn long feedback loop. That is very challenging, coming from a founder background where I lived and died by my month. My results were very measurable.

One of the internal metrics that's very important to me, beyond the next up round, I call it the say-do ratio. If I say I'm going to do something, do I actually do it? For me personally, the one thing that we always say we do is that we are hands-on investors. We help our founders.

I will always be a founder first, and I always want to feel that I'm doing right by the founders and that I am delivering on that value proposition. Ultimately, that's also where I can deliver the value to my LPs.

My advice to every founder is that the smartest founders curate their cap tables. I have a very clear role and value proposition. When we're investing at the pre-seed and seed, if you don't go from zero to one, if you don't land those first clients, you're not going anywhere, and I can help you get there. That’s how I measure it. Have I helped them clarify their value? Have I worked with them on the process? And frankly, I pick up the phone and I make the introductions. I actually do quantify those.

Trends and Future Vision

Exciting Trends and Technologies

Because of my background, I'm really excited about the future of commerce and how AI is going to transform it. I think about it in three buckets.

The first one is that agentic shopping is coming. Whether it's in a B2B or B2C context, what's going to happen when you're no longer making every single shopping decision, but you have agents, and how is that world going to transform?

The second piece is, in this world, how do we think about payments, scalability, authenticity, verification, and cybersecurity in this agent-to-agent world?

The third part, which I was a CMO and marketer for a very long time, is how brands are going to be discovered in this world. One of our most recent investments is a company called Athena that is GEO, or generative AI optimization. What happens in a world where it's no longer just you going to Google and saying, "I'm looking for eyeglasses." Now you can have a whole consultation. How do brands control that conversation? It's going to come at us fast.

Misconception About VCs

That it's a cushy, easy job, it's a really interesting job in that it's like eight jobs rolled into one, and there's always more that you could be doing in any one of those areas.

Whether you're fundraising and talking to LPs, brand building for the fund, supporting your founders, or sourcing, the reality is that if you're not seeing the best deals, you can't invest in them. I find it intellectually very stimulating, but it's also very challenging because each of those rabbit holes is so complex.

Improving the VC Ecosystem

I understand why people tend to go to the safe bets, the big names. If you think about it in a macro perspective, venture capital is a tiny little sliver of private equity. It is already a subset of a subset. And then on top of that, you're going to throw a wrench in with emerging managers or unproven managers, even if you have proof in other ways.

I wish there were an easier way for LPs to understand and to see the value of why you want to invest in emerging managers, why these outlier voices can lead to outlier returns. But sometimes I've come to the conclusion that it just sucks to be new. The only thing I can do is provide exceptional returns, prove that I am really great, and then it'll come.

Challenges for Early-Stage Founders

It is still a world of haves and have-nots. We went through the ZIRP era and crazy valuations, and everybody was getting funded. Now it's been a very tough couple of years.

Part of it is that specific categories, namely AI, are very hot. Too hot, perhaps. We need to go back to discipline and capital efficiency. But on the have-nots, it's about how you help them with their messaging? How do you help them access the right venture capitalists?

I always provide value. I always think about the person who took half an hour to talk to me. What can I give back even if the answer is no? Can I give them some feedback? Can I provide them with an introduction? A pointer? A simple, "Hey, you should explain this better." I always think about that.