Robert Wesley - Cameron Ventures

"One of the best pieces of advice I’ve taken to heart is the idea of increasing your surface area for luck."

Connect with Robert

https://www.linkedin.com/in/robert-wesley-9494b1120/

VC Uncovered's View

Robert’s approach at Cameron Ventures offers a refreshing reminder of what early-stage investing can be: a genuine partnership built on trust and a shared vision for the future. Cameron Ventures, with its focus on Fintech, Insurtech, and Enterprise solutions from Seed to Series A, embodies the kind of patient, founder-centric capital that truly empowers innovation.

His emphasis on the "alchemy" of combining limited data with a strong conviction in the team and their mission speaks directly to the boldness we believe is essential in today's rapidly evolving market.

Robert's insights into increasing one's "surface area for luck" and the foundational importance of integrity resonate deeply with our belief that the future of venture isn't just about writing checks; it’s about rolling up your sleeves, fostering genuine relationships, and building alongside founders through every challenge and triumph.

At Cameron Ventures, they aren’t just VCs; they aim to be true partners, and Robert’s approach is a testament to that ethos, showcasing how nimble, focused firms can make a profound impact by backing determined founders who are making lives better.Meet Robert

Q: If you could be anywhere, eating, drinking, and reading whatever you like most, where would you be and what would those things be?

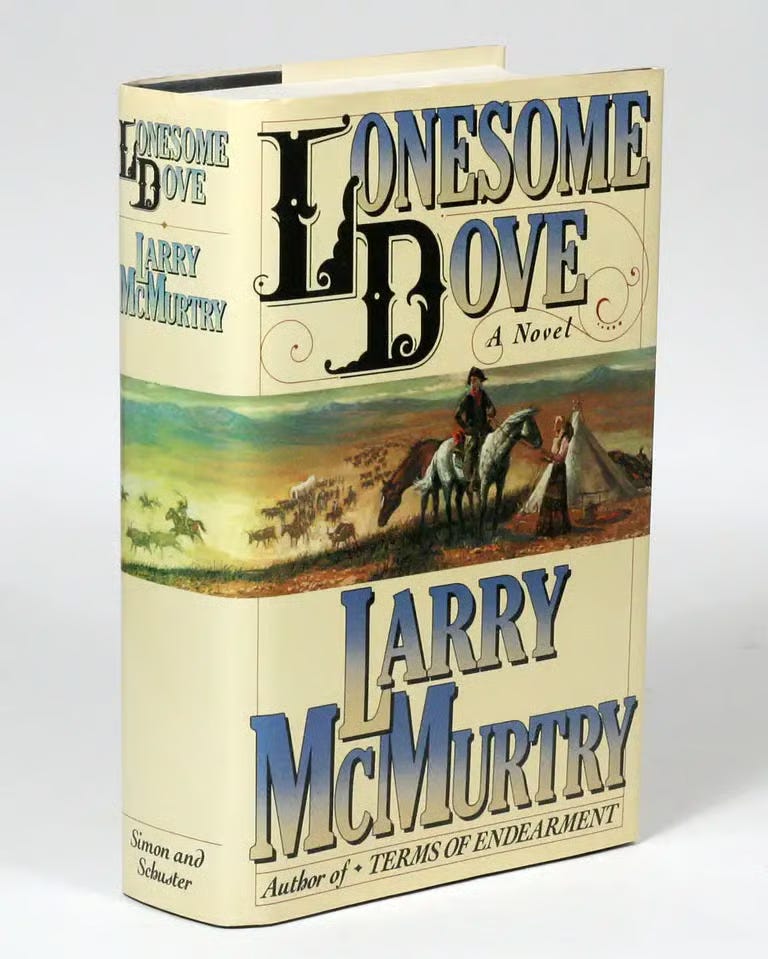

A: Outside The Page on a sunny Friday afternoon with a Pliny the Elder and Lonesome Dove by Larry McMurtry

Key Quotes

"One of the best pieces of advice I’ve taken to heart is the idea of increasing your surface area for luck."

"Marrying what sound analysis you can do with limited data, a strong view of a founder team’s capabilities, and the market they are tackling is the real alchemy of early-stage venture."

"I always start with trust and integrity as table stakes for partnership with a founding team. Sterling reputations compound."

"The best pitches I leave feeling energized. I’m so excited about their vision that I can’t wait to share with my team."

"Founders build companies, not VCs. It’s the founders that are innovating and pushing the world forward."

Original Responses (Lightly Edited for Clarity and Flow)

Background and Personal Journey

Moment Inspiring Venture Capital Career

I don’t think I would point to a specific moment or insight, but more a culmination of my interests and experience. My first job out of school was in research at Financial Technology Partners, which is an amazing place for someone hungry to learn and with an early interest in FinTech. I got to work under incredibly sharp people, many of whom had already spent virtually their entire careers in financial technology and had worked with both early and growth-stage businesses.

That environment as an introduction to FinTech as an industry, and moving to the Bay Area, helped nurture my early love of startups and their potential to reshape the world we live in. It was here that I fully fell in love with FinTech and recognized a passion for working with founders at the earliest stages. I loved the depth that we got helping companies raise capital, but I craved the opportunity to pair this with the longer-term partnerships that venture at the earliest stages seemed to offer.

Balancing Intuition with Data

At the stages we spend most of our time (Pre-Seed through Series A), the amount of data is typically very little. There is occasionally enough where you can sketch a rough picture of where the business could go in the future, but our work is largely a bet on the team and the problem they are solving.

When I first transitioned to venture, this was pretty challenging for me, having spent time in banking at the later stages, where much more data is available. I think I’ve come to view the more data-driven approach as a double-edged sword. Are there valuable insights about the business's health and prospects based on historical data and future assumptions? Absolutely. But you can always find reasons in the data not to do a deal, just as you can find reasons in favor of the deal. Marrying what sound analysis you can do with limited data, a strong view of a founder or team’s capabilities, and the market they are tackling is the real alchemy of early-stage venture.

Best Advice Received

One of the best pieces of advice I’ve taken to heart is the idea of increasing your surface area for luck. Even the largest successes are extremely hard to predict in this business, and there are many situations where even the early believers were completely wrong on their original thesis, or the outcome is 5 to 10 times what they thought was possible. Obviously, this isn’t always the case, but it probably happens more than people realize.

The good news is that you can dramatically increase the odds of good things happening to you. That long-shot cold outreach or meeting someone by chance at a networking event you didn’t feel like going to. Often it isn’t even the original person you met, but you hit it off with them and they put you in touch with someone building in an area that is squarely in your wheelhouse, or someone that you end up co-investing with.

Of course, capitalizing on opportunities when you meet a truly incredible founder or see something that excites you is a separate skillset, but getting the opportunity in the first place is all driven by putting yourself in situations where something amazing like that can present itself.

I think it is important to remember this when working in a role that is often very ambiguous and has no standard way to spend your time. I’ve tried over the years to continually expand the aperture of what might be useful time spent, which has led not only to interesting deals but also to great friendships and opportunities that I wouldn’t have otherwise ever encountered.

Philosophy and Insights

Values When Working with Founders

I always start with trust and integrity as table stakes for partnership with a founding team. With every investment you make, you’re hoping for a productive, long-term relationship, and these are crucial for building the trust necessary to work together effectively. This bleeds over into everyday operational excellence as well. New hires are brought on and retained as valuable contributors by people they are drawn to and can trust. Customer and counterparty deals get done because they know they will be treated well and are being dealt with in good faith. Sterling reputations compound.

This is on the investor side as well as the founding team. This relationship is a two-way street, and that trust that you build with a founder allows for much more candid communication on both successes and pain points.

The Perfect Founder Pitch

The best pitches I leave feeling energized. I’m so excited about their vision that I can’t wait to share it with my team. This tends to come from remarkable clarity on the problem they are solving, their customers, their strategy to execute, the economics of their business, and why they are the team to do it. I love learning from founders, and if I can leave a pitch feeling well enough informed to articulate to my team all of the above clearly, we’ve had a very productive meeting.

Measuring Success Beyond Returns

People always say it, but this is a relationship-driven business. I’ve been extremely lucky to meet some incredible people and develop amazing friendships over the course of my career. Continually learning and spending time with some of the world's smartest, most driven people is a fascinating situation to be in at any point in your career.

Additionally, we're a single LP fund with ties to a portfolio of financial services operating businesses we work closely with. We're constantly trying to put entrepreneurs in front of those executives to explore ways to work together. While a bit harder to quantify, those learnings and synergies we've been able to facilitate across our portfolio, and even outside of the teams we invest in, are a huge part of how we view success as a fund.

Trends and Future Vision

Exciting Trends and Technologies

The big one almost has to be AI. The last decade was dominated by software, and while we don’t think great software will be displaced overnight, how does AI impact the ability to build and deliver the next generation of great software products? How will incumbents and even relatively new platforms integrate AI into their existing product suite? Are agentic workflows the right wedge to replace existing software entirely in some areas?

We spend almost all of our time in FinTech and InsurTech, and we think there is still a ton of work to be done to modernize with this in mind. Data interoperability, new ways to deliver personalized financial, health, and wellness plans, employment markets, and benefits shifting; there are so many exciting areas we want to see talented folks building in.

Misconception About VCs

Most people should know this, but founders build companies, not VCs. It’s the founders who are innovating and pushing the world forward. Of course, investors can be helpful in certain areas, but it’s all on the margin. The founders themselves are the ones bringing the ideas to life, who decide on a path and pursue it. Excluding those that explicitly help founders ideate and decide on an idea to pursue, venture dollars are largely just a source of fuel to execute on a founding team's vision.