Tim Streit - Grand Ventures

"The best ideas are focused on one of two extremes. They appear too obvious to have been overlooked up until now, or they appear too outlandish to be possible."

Connect with Tim

www.linkedin.com/in/tim-streit

VC Uncovered’s View

The VC world often celebrates the predictable, backing founders who operate within the familiar ecosystems of Silicon Valley and New York. But real innovation rarely follows a script. And it certainly doesn’t confine itself to coastal hubs. Tim Streit, co-founder of Grand Ventures, represents the new wave of “emerging managers” who understand that transformative companies can be built anywhere, often by those who have been underestimated.

Based in Michigan, Grand Ventures operates with the agility and conviction that we champion at VC Uncovered. The firm focuses its investments on early-stage founders disrupting massive markets like fintech and supply chain. They aren’t afraid to provide the first institutional check and, crucially, they roll up their sleeves to build alongside founders (a stark contrast to the passive capital often deployed by most legacy funds).

Tim’s approach nods to his roots in suburban Detroit. The son of two public school teachers, he understands the power of belief and the drive that comes from having something to prove. He’s sidestepping polished pedigrees to look for the “underdogs” with relentless drive. This perspective allows him to identify opportunities at the extremes, ideas that seem either too obvious or too outlandish for traditional VCs to touch.

Most innovation today is fueled by micro VCs and emerging managers: investors who share the same challenges as the founders they back. Grand Ventures offers a necessary alternative to mega-funds, prioritizing collaboration and deep partnership over mere deep pockets. Tim invests in the potential of overlooked regions and the power of the underestimated founder, proving that the next generation of venture leadership is already breaking barriers far from the spotlight.Meet Tim

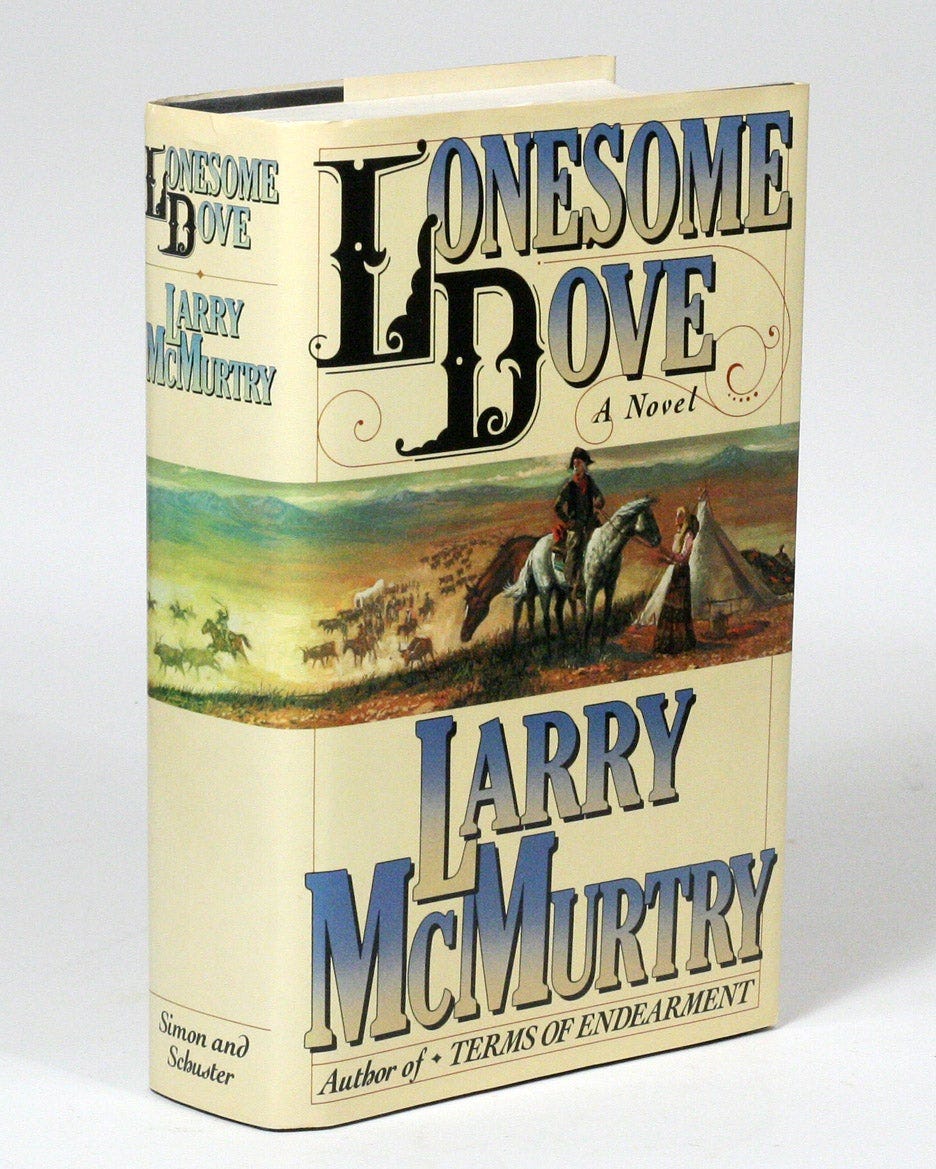

Q: You can be anywhere. Eating, drinking, and reading your favorite thing. What is it?

A: There’s no place better than Michigan in the Summer. I’d have steaks on the porch at our lake house, then drinks on the dock at sunset surrounded by family and laughter. Most days, I devour autobiographies by famous leaders, athletes, and artists - trying to learn from the greats! On vacation, I love historical fiction, like Lonesome Dove by Larry McMurtry.

Key Quotes

“I love to back underdogs with a chip on their shoulder and a relentless drive to break through barriers.”

“The best ideas are focused on one of two extremes. They appear too obvious to have been overlooked up until now, or they appear too outlandish to be possible.”

“If it works, it will be big. Don’t be afraid of risk.”

“Trust your gut. Test it with customers. Prove it with data.”

“Most of today’s innovation is being fueled by micro VCs and emerging managers — people like us who operate at the earliest stages and are often facing many of the same challenges as the founders we back.”

Original Responses (Lightly Edited for Clarity and Flow)

Background and Personal Journey

Experiences Shaping My Investment Approach

I grew up middle class in suburban Detroit. My parents were both public school teachers, and we lived a simple, grounded life surrounded by family, friends, and nature. Sports were a huge part of my upbringing, I played quarterback and point guard, and I loved competing to help my team win. Sports taught me leadership, teamwork, and the importance of showing up for others.

My parents always told me, “You can do anything, the sky’s the limit.” That belief shaped how I view possibility. Over time, I realized I was breaking the norms of what was expected of a middle-class public school kid. I wasn’t supposed to be here, and that feeling of being underestimated stuck with me. Today, I look for those same traits in founders, the bold ones with something to prove. I love backing underdogs with relentless drive who defy expectations.

During college, I worked in restaurants, cooking, waiting tables, doing dishes, and it taught me humility. No job is too big or too small. You can’t appreciate the good if you haven’t tasted the bad. Every day was a chance to learn something new, and that mindset has carried into how I invest.

I’ve lived in Maui to surf and wait tables, backpacked through national parks, and spent months in Spain. Travel gave me perspective: life is bigger than me. Happiness comes from relationships, experiences, and purpose, not wealth.

That outlook defines how I invest. I’m drawn to founders who see the world not just as it is, but as it could be, people with curiosity, courage, and conviction. In many ways, I invest in the same kind of people and ideas that shaped me, underdogs with big dreams who believe the sky really is the limit.

Moment Inspiring Venture Capital Career

I graduated college during the aftermath of the dot-com bubble and started my career in investment banking. It was an incredible learning experience, fast-paced, analytical, and humbling. But after three years, I knew I wanted something more. I applied to business school, and one of the essay questions changed my life: “What do you want to leave as your legacy?”

That question forced me to stop and think. My grandfather was a Lutheran pastor in downtown Detroit, and my parents were both teachers. My role models had dedicated their lives to helping others and making their communities better. I wanted to follow in their footsteps, but in my own way, to build something hard, meaningful, and lasting.

So, I wrote: “I’m going back to school to build the skills and network to start a venture capital fund whose mission will be to build the next generation of leading companies in Michigan, companies that create jobs, wealth, and vitality in their communities.”

Harvard didn’t buy it, but I was naive, or bold, enough to believe it anyway. So I dedicated my life to making it happen. After earning my MBA and working at HSBC, I moved back to Michigan and launched my first fund, Huron River Ventures, in 2011.

It was harder than I imagined, but we did it. The State of Michigan anchored the fund, and we went on to back incredible companies, leading early rounds in Ambiq Micro (EdgeAI, IPO 2025), SideCar (a pioneer in ridesharing), FarmLogs (a Y Combinator AgTech innovator; now Bushel Farm), SkySpecs (autonomous drone inspection), and Huntwise (the #1 hunting app, later acquired by Kalkomey).

That original essay became my blueprint. Two decades later, I’m still following it: investing in people and companies that make the world around them better.

Influences on My Worldview

My worldview has been shaped most by my faith and upbringing. I grew up in a Christian home, surrounded by people who lived with purpose. My grandfather was a pastor, and my parents were teachers, all dedicated their lives to helping others. That example became my compass.

I’ve always felt a calling to serve, to use my energy and experience to help people reach their potential. That’s what drew me to venture capital. VC doesn’t stop at investing in companies; revolves around helping founders succeed so they can create jobs, build communities, and change lives. When a founder wins, so do their employees, shareholders, and neighborhoods. That ripple effect is what motivates me.

Faith also gives me perspective when things get hard. Venture is humbling. You’re reminded daily that you’re not in control of every outcome. I try to stay grounded in the work and trust that purpose leads to progress, even when results take time.

My faith keeps me humble, my training keeps me disciplined, and my experiences keep me believing that anything is possible when you bet on the right people.

Unconventional Belief

I believe the best ideas usually live at the extremes. They’re either so obvious people can’t believe they were overlooked, or so outlandish most assume they’ll never work. Those are the ones that get my attention.

The “obvious” ideas are often hiding in plain sight, waiting for the right founder with the clarity and execution to make them real. The “outlandish” ones demand conviction in the face of doubt. In both cases, these founders see something others don’t and have the courage to prove it.

I’ve always believed that no mountain is too high. The biggest breakthroughs start as ideas others dismiss. Venture capital, at its best, is about taking big swings and getting comfortable with uncertainty. As I tell my team and founders often: “If it works, it will be big. Don’t be afraid of risk.”

That belief comes from experience. Having been underestimated myself, I know what happens when someone believes deeply in something others can’t yet see. In early-stage investing, risk isn’t something to avoid; it’s the raw material of progress. My job is to spot when that risk is intelligent, and when the founder behind it has the grit to see it through.

Balancing Intuition with Data

For me, the best founders—and the best ideas—always start with a customer-first mindset. If you can truly surprise and delight your customers, you’re on the right track. That principle sits at the center of how I invest.

My background in engineering and finance makes me naturally analytical. I rely on data because it tells the truth, what’s working, what’s not, and where real traction exists. Data brings clarity when everything else feels uncertain.

But early-stage investing also requires intuition, the ability to sense when something’s working before the numbers prove it. The best founders often build in markets where data doesn’t exist yet. That’s when experience, judgment, and pattern recognition matter most.

I think of it as a simple formula: trust your gut, test it with customers, and prove it with data. Your gut is the hypothesis, customers are the validation, and data is the proof. When all three align, you’re onto something special.

At the end of the day, venture is both art and science. You start with intuition, ground it in reality, and let data confirm what conviction already suspected. That’s where curiosity meets evidence, and where real progress begins.

Best Advice Received

The best advice I’ve ever received is simple: Anything is possible. My parents said it often, and it’s shaped nearly every step of my journey. That belief pushed me not to settle early in my career, to dream big, take chances, and trust that faith and hard work would open the right doors.

My grandfather added another layer: In everything you do, do it well. Whether I was washing dishes, building financial models, or raising my first fund, I learned to take pride in the work itself. That mindset has served me well in venture, where details, integrity, and follow-through matter.

I’ve also learned that anything worth doing usually feels impossible at the start. Launching my first fund in 2011 certainly did, but if it were easy, everyone would do it. The challenge is what makes it meaningful.

And finally, one of my own guiding beliefs: Adventure is always around the corner. My travels and time living abroad taught me that growth comes from stepping outside your comfort zone.

Those lessons, faith, excellence, perseverance, and adventure, are my compass.

Philosophy and Insights

Investment Philosophy

If I had to describe my investment philosophy in one sentence, it’s this: I’m a high-conviction contrarian who backs founders bold enough to build what others thought impossible.

I’m not drawn to incremental improvements. I look for founders who see the world differently, who combine vision, courage, and execution to create entirely new categories.

I often think of Roosevelt’s “Man in the Arena”: credit belongs to the doer, not the critic. My funds are my arena, and every day I feel grateful to help founders dare greatly and build companies that will outlast all of us.

Values When Working with Founders

When it comes to working with founders, three principles guide me: passion, resilience, and honesty.

Passion means having a genuine, customer-first mindset. The best founders have lived the problem, they’ve felt the pain firsthand and can’t rest until they solve it. That kind of purpose-driven energy can’t be faked; it’s what sustains them through the long nights and tough calls that come with building from scratch.

Resilience is just as critical. Every founder will face setbacks, often more than they expect. The great ones don’t run from them; they learn, adapt, and push forward. In venture, we’re not betting on perfection; we’re betting on persistence.

And finally, honesty and positive energy. I try to surround myself with founders and partners who bring out the best in each other, who communicate openly, challenge constructively, and share a genuine optimism about what’s possible.

Those three qualities, passion, resilience, and honesty, form the foundation of every great partnership. They’re what turn early-stage chaos into lasting companies, and what make this work so meaningful.

The Perfect Founder Pitch

The perfect pitch, to me, starts with a big idea: something bold enough that it might look “impossible” or even a little crazy at first glance. I’m not interested in incremental improvements or minor efficiencies. I get excited when a founder sees the world differently, identifies a gap others have missed, and is chasing a vision that, if it works, could redefine an entire category.

But big ideas alone aren’t enough. The best pitches also show action. I love meeting founders who are already building, testing, learning, and iterating quickly. They’re not waiting for perfect data or permission to start. They’ve already taken the leap and are gathering real-world feedback. That kind of velocity tells me they’re adaptable, grounded, and committed to learning fast.

I also look for focus and agility, the ability to balance conviction with flexibility. Every journey looks cleaner on a slide deck than it does in real life. The best founders understand that early-stage building is messy and unpredictable. They don’t get paralyzed by the unknown. They just keep moving forward, learning, adjusting, and refining their thesis along the way.

In terms of stage, my sweet spot is between inception and product-market fit. That’s when founders are still shaping the DNA of the company, the culture, the mission, the first product decisions. It’s where I believe I can add the most value, both as a thought partner and as someone who’s lived through those early, uncertain chapters before.

So, the perfect pitch isn’t the most polished or the flashiest. It’s the one that’s ambitious, focused, and authentic, from a founder who’s already in motion, tackling something that others think can’t be done.

Approach to Risk

Risk and setbacks are inevitable in venture; they’re part of the game. Over time, I’ve learned not to treat all risk the same. Some risks are insurmountable; others just need to be managed or navigated.

The ones I avoid are structural, broken unit economics, small markets, or models that require changing entrenched customer behavior. Those rarely improve with time or capital.

But I’m comfortable with the kind of risk that comes with true innovation, uncertainty around timing, product-market fit, or adoption. Those are the bets worth making, especially with talented, resilient founders who learn fast and adapt.

My view of risk has evolved from trying to eliminate it to focusing on understanding it. The goal isn’t to avoid risk but to know exactly which kind you’re taking, and why. Intelligent risk, paired with conviction and great execution, is what drives outsized returns.

Measuring Success Beyond Returns

I’ve always believed success in venture capital goes far beyond financial returns. I measure it by the companies built, jobs created, and wealth generated in the communities we serve.

Grand Ventures was founded on the belief that great companies can be built anywhere, not just in Silicon Valley. When one of our portfolio companies grows and hires locally, it creates more than shareholder value; it creates opportunity, confidence, and momentum for an entire region. That’s the kind of impact that lasts.

Financial outcomes matter, they’re the scorecard that keeps us accountable. But what truly motivates me is watching a founder turn an idea into something real, build a team around it, and make a difference in people’s lives.

At its core, venture capital is about fueling progress, helping the next generation of innovators shape industries, create jobs, and build a better future. The financial returns follow when you focus on that.

Trends and Future Vision

Exciting Trends and Technologies

From my vantage point in fintech, AI is the most transformative innovation of our time. It’s changing how we live, work, make decisions, and interact, and it’s touching everything from payments and authorization to compliance, settlement, and ledgering.

We’re at an inflection point where AI isn’t just improving existing workflows, it’s redefining them. It’s freeing people from repetitive tasks so they can focus on creativity, problem-solving, and higher-value thinking. It’s also accelerating research and decision-making in ways that will compound over time.

In fintech, this means faster underwriting, more personalized advice, real-time risk management, and a more inclusive financial system overall. But beyond that, AI represents something bigger, a fundamental shift in how humans and technology collaborate.

As founders and builders, we need to rethink every process and assumption through this new lens. The next era of innovation won’t just revolve around using AI as a tool, it will reimagine entire industries around what it makes possible.

Misconception About VCs

One of the biggest misconceptions about venture capital is that unicorns can only be built in San Francisco or New York. The truth is, innovation is happening everywhere, in big cities, small towns, and places that most people overlook.

At Grand Ventures, we’ve seen firsthand how much talent and creativity exist outside the traditional hubs. We love meeting founders where they are, both geographically and strategically, and helping them along the journey. We only invest when we believe we can be hands-on partners, adding real value beyond the check. That often means working closely with founders in the Midwest, Southeast, and other regions where early capital and networks have historically been harder to access.

Another misconception is that all venture capital firms are large, established institutions. The reality is that most of today’s innovation is being fueled by micro VCs and emerging managers, people like us who operate at the earliest stages and are often facing many of the same challenges as the founders we back. We’re raising funds, building teams, and proving ourselves every day.

That shared experience creates empathy. We know what it feels like to fight for belief and momentum in the early innings. That’s why I see venture capital not as gatekeeping innovation, but as enabling it, helping visionary founders everywhere turn bold ideas into lasting impact.

Improving the VC Ecosystem

If I could improve one thing about the venture capital ecosystem, it would be collaboration.

I’d love to see more VCs, especially across stages and fund sizes, working together to support founders. Regional micro VCs tend to collaborate naturally because we’re aligned on ownership and share a “let’s build it together” mindset. We know that real value creation happens when great investors combine networks, expertise, and conviction early on.

Where collaboration often breaks down is with larger funds that have higher ownership targets. That structure can make it harder to co-invest, which I see as a missed opportunity. When funds compete for ownership instead of partnership, it limits what we can collectively build, both for founders and for the broader ecosystem.

The rise of mega funds pushing into pre-seed and seed rounds has also changed the landscape. In some ways, it’s made fundraising harder for emerging managers, and in others, it’s created challenges for founders who need hands-on, early-stage support. Large funds often have less incentive to roll up their sleeves for smaller checks, which can leave founders without the mentorship or time-intensive help they really need at that stage.

I’d like to see the industry evolve toward a model where each investor type, large, small, institutional, regional, plays to their strengths and complements the others. There’s room for everyone, and the best outcomes happen when we collaborate, not compete.

Let’s find better ways to build, together.