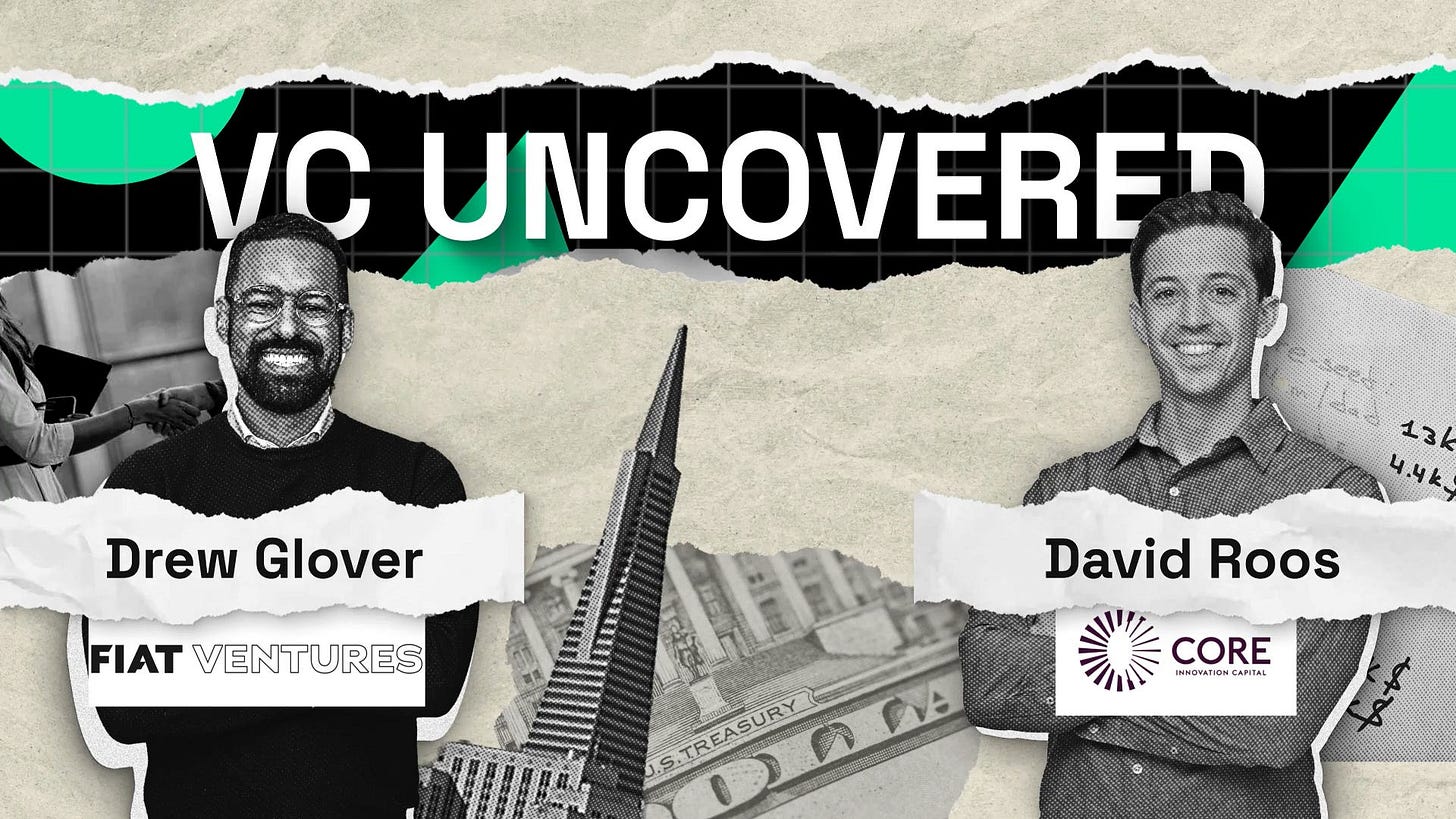

David Roos - Core Innovation Capital

Read his VC Uncovered Profile: https://www.vcuncovered.com/p/david-roos-core-innovation-capital

Podcast Summary:

Drew Glover (Fiat Ventures) talks to David Roos from Core Innovation Capital on the power of the "anti-mega fund" and investing to "do good and do well". David details his journey from a lucrative but unfulfilling career in fixed-income trading to venture capital, explaining why he believes smaller, strategic funds are better for founders. He argues that mega-funds often treat seed rounds as mere "option bets" and are incentivized to play a "management fee game" , while his ~$100 million fund takes meaningful ownership and is truly aligned with building fund-returning businesses.

The conversation gets really interesting when David explains how Core quantifies its impact thesis. He introduces their "trillion dollar metric" —an audacious goal to create $1 trillion in net new worth for everyday people by investing in companies that save them money or help them earn more. He also offers a provocative take on Direct-to-Consumer FinTech, declaring it "very much alive" and poised for a new wave driven by AI-powered personalization and automated finance.

Sponsor:

This season is supported by SVB. Silicon Valley Bank, a division of First Citizens Bank. Member FDIC.

SVB is a trusted collaborator for the founders pushing boundaries and the investors who back them. We're proud to have them as our sponsor.

Please note, this podcast is for informational purposes and is not investment, financial, or legal advice. The views expressed are those of the speakers and do not necessarily reflect the position of SVB.