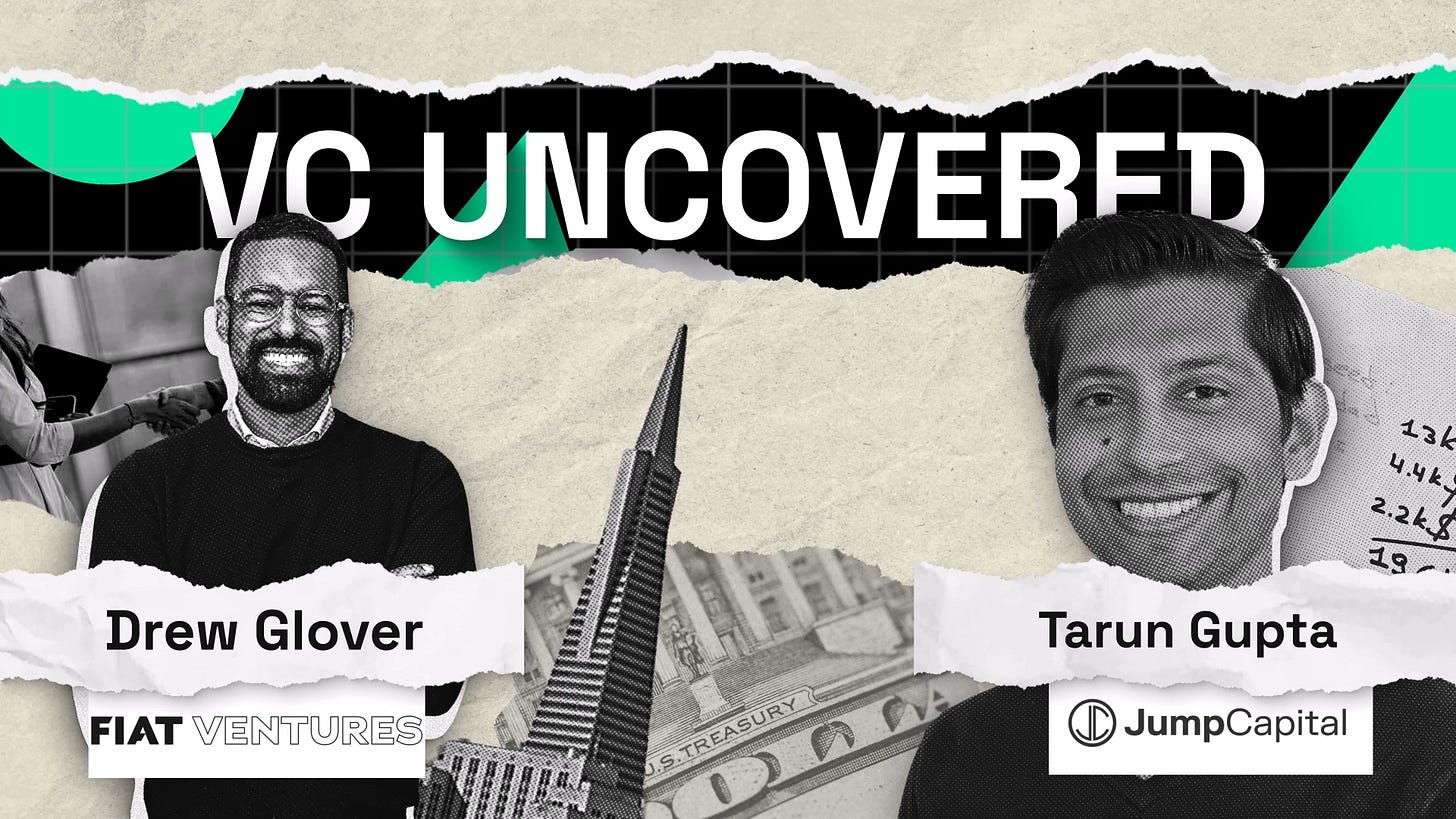

Tarun Gupta (Jump Capital)

Read the VC Uncovered Profile:

https://www.vcuncovered.com/p/tarun-gupta-jump-capital

In this Podcast:

Drew Glover talks to Tarun Gupta, Partner at Jump Capital, for a deep discussion on the foundations of high-conviction, early-stage venture capital investing. Drawing on his previous experience in M&A and corporate development within the sports betting industry, Gupta outlines his unique, outcome-oriented approach to identifying generational companies. Central to his philosophy is the “Quit Your Job” litmus test, asserting that a strong investment must inspire such belief in the founder and the problem that an investor would seriously consider leaving their post to join the venture. Furthermore, Gupta challenges the conventional reliance on Total Addressable Market (TAM), arguing that an overly narrow focus can cause VCs to overlook revolutionary companies like Uber or Toast, whose founders ultimately define new market opportunities through clarity of execution.

Gupta explains that this strategic foresight extends to approaching every investment with an M&A mindset from inception. He stresses the critical importance of positioning a company for exit and having frank discussions with founders about the optimal timing for a transaction—often before they feel they have reached their peak value creation. The conversation also explores how Jump Capital is strategically engaging with the rapid advancements in Artificial Intelligence. Gupta clarifies that their focus transcends merely using AI to improve margins in existing services. Instead, they seek out AI-enabled business models that can profitably serve previously un-addressable or underserved markets, thereby creating new, venture-backable categories.

The episode concludes with a rapid-fire Q&A session where Gupta offers sharp insights on specific investment topics. This includes analyzing the success of the live online gaming company Evolution Gaming, recognizing the surprising, transformative operational efficiency of AI note-takers for VCs, and identifying London and the UK as a primary target for international FinTech investment due to its unique market position and talent pool.

Sponsor:

This season is supported by SVB. Silicon Valley Bank, a division of First Citizens Bank. Member FDIC. SVB is a trusted collaborator for the founders pushing boundaries and the investors who back them. We’re proud to have them as our sponsor.

Please note, this podcast is for informational purposes and is not investment, financial, or legal advice. The views expressed are those of the speakers and do not necessarily reflect the position of SVB.